- Couch Potato

- Posts

- Couch Potato #2: Xometry 101

Couch Potato #2: Xometry 101

Couch Potato #2: Xometry Q2 Earnings

Welcome to Couch Potato where every week I will share analysis and updates on vertical software and marketplace companies. Subscribe to follow along and stay up to date!

Most people think of Amazon, Ebay, Uber and Airbnb when they hear the word “marketplaces”. Not surprising since these companies represent 4 of the most prominent public marketplace companies in history. Prominent because of market cap, of course. But also through a deep penetration into our cultural fabric. It is highly likely that if you are reading this newsletter, you have used at least 3 out of these 4 marketplaces. Most of these commonly known marketplaces are either business-to-consumer (B2C) or peer-to-peer (P2P). But there is a third category of marketplaces that are often overlooked: business-to-business (B2B). Let’s take a look at one such B2B marketplace today - Xometry ($XMTR)

Xometry: Overview

Xometry is an online marketplace connecting buyers looking to source manufactured parts and assemblies to suppliers of manufacturing services. Founded in 2013, it allows buyers to procure products on-demand and suppliers can acquire demand that matches their process and capacity. At this point in this description it might be hard to imagine the specific parts being transacted on Xometry. Here’s an example of the process. Buyers upload a 3D design engineering schematic (“CAD file”). Xometry’s AI scopes the project and creates a quote instantly based on volume, process, material etc. The parts could be metal or plastic using a variety of techniques - CNC, Sheet Metal, 3D Printing, Injection Molding etc for critical components in satellites, rockets, medical devices, electric vehicles, robotics etc. Now, I am going to pretend I fully understand all these manufacturing styles beyond 3D printing. But it is a large player in a huge market. Xometry (as of 8/12) has a $773M market cap with over $418M in LTM revenue.

Source: Xometry Q2 Earnings Presentation

Management estimates their global market size for their primary key manufacturing processes at $260B (gross revenue). Xometry is valuable because it (a) increases business for suppliers by connecting them with relevant buyers, (b) buyers get instant pricing and hyper personalized lead times, (c) buyers can access a broad international base of suppliers, and (d) suppliers can run their business using actionable data. Currently, Xometry has over 10k suppliers on the platform. Buyers range from startups to F500 companies.

Q2 Results Overview

Xometry released their Q2 earnings this week. Now I know this week has been filled with dozens of prominent companies releasing earnings (Airbnb, Lyft), I am surprised by how little coverage Xometry received this week. Anyway, let’s dive in.

Xometry’s revenue comes from two primary revenue streams: marketplace revenue and supplier services. They had a third revenue stream - Xometry supplies - which was primarily a materials supply business. Xometry started winding down this business unit in June. Let’s come back to that in a bit.

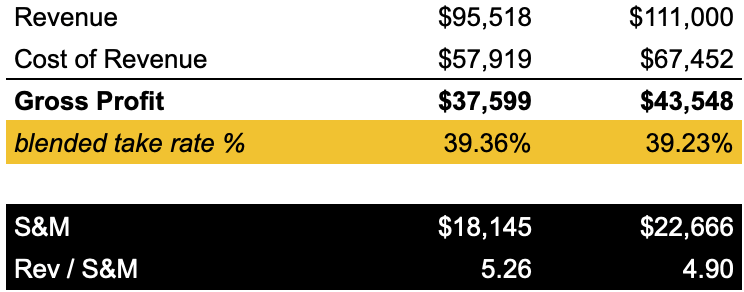

Source: Couch Potato / Paraj Mathur using Xometry Q2 Earnings Data

While Xometry’s shuttering of their supplies business accounts for some of the decline (~$1.7mm), it’s clear that the majority of growth is coming from their core marketplace business. What is fascinating here is the stickiness of their customers. 96% of revenue is coming from existing accounts (what is their sales team doing?) and older cohorts are expanding platform spend by 2-2.5x in 3-5 years. I am curious if this is due to horizontal expansion or an increase in vertical volume. Might be too much data to ask for - don’t know any other marketplaces disclosing cohort data.

Source: Xometry IR Q2 Earnings Presentation

One key aspect to call out. Xometry transactions run through the company as an intermediary. This means that revenue is the equivalent of gross bookings, and gross margin subtracts the cost of revenue, which here is the amount paid to suppliers. As a result, net revenue here is the gross margin. Over time, Xometry has increased gross margin on their marketplace business to 31.7% - which is high for marketplaces. Next edition, I will share some data on public marketplace take rates and multiples, market caps, and profitability.

While customer stickiness is exciting - two things standout to me. The 2021 cohort was significantly more active than previous cohorts in their first year. Considering that 96% of revenue is coming from existing cohorts, new customer acquisitions must have slowed down. We see that S&M efficiency is down 7% compared to a year ago.

Source: Couch Potato / Paraj Mathur using Xometry Q2 Earnings Data

One rough test I like is looking at activity on one side of the marketplace and fully loading the CAC on that side. In this case, let’s look at active buyers and assume 100% of S&M is to acquire buyers (and since no buyers without sellers, assume marginal CAC for sellers = $0. Active buyers increased by 14,803 compared to a year ago. That would roughly imply a $1500 CAC per new active buyer. If we peanut-butter spread the revenue across active buyers in this period, gross profit per active buyer is roughly $900, which means 1.7 quarters to breakeven on the CAC. Not bad for a quick gut check. Before I get cancelled on the internet, I know I took a few liberal shortcuts here - CAC should have been delayed a whole year, active buyer delta does not necessarily mean new buyers, and some might frown on fully loading the CAC to one side of the marketplace. Like I said, less of a mathematical proof, more of a quick gut check. This data could be even more alarming. It’s unclear how Xometry categorizes active customers vs active accounts vc active buyers. They keep changing the nomenclature when they share performance data which makes me think they are meaningfully different things. For example - if a customer (eg = Lockheed Martin) has an account (Denver Office) and a buyer (Engg Team 1), its possible Xometry still has to spend $ to acquire a different account (New York Office) or buyer (Engg Team 2) but still counts it as revenue from the same customer/account (Lockheed). That would be misleading and make this data a lot less reliable, and frankly, worse.

Okay so I promised a short commentary on Xometry’s supplies business and here it it. It is clear that is was a small business unit and it’s probably part of an effort to offload costs. But while digging around I found a couple interesting tidbits. First, it’s possible that Xometry was simply dropshipping supplies through a third party vendor. My guess? OnlineMetals. I heard whispers in some machinist forums that Xometry was simply dropshipping at deeply discounted prices. That would irk OnlineMetals and it’s possible they asked to renegotiate or cut them off completely leading to this shutdown. Management has not concretely commented on this. That’s the gossip on the street about this.

Over time, I plan on including more data around consensus estimates, guidance, and whether they beat and raise estimates or not for the companies I talk about. For now, I am just excited to geek out over interesting marketplaces and Q2 earnings is a good excuse.

I am spending a lot of time with B2B marketplaces in the private markets at the Series A and B stage right now. If you are reading this and you are a founder of a B2B marketplace in the US at those stages - hit reply or DM on Twitter. I would love to chat.

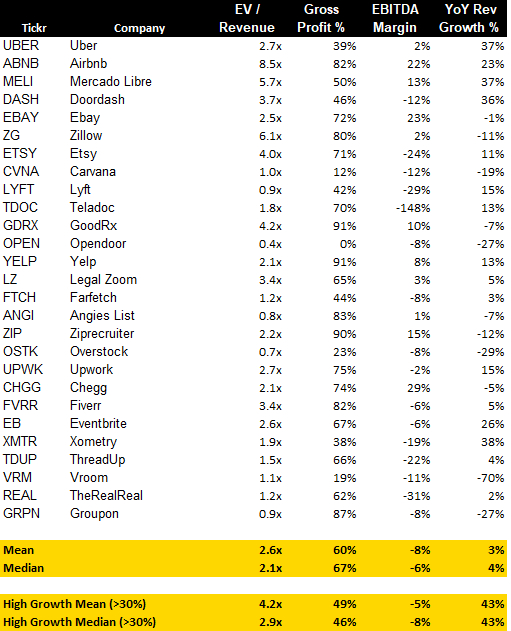

Marketplace Multiples 8/13/2023

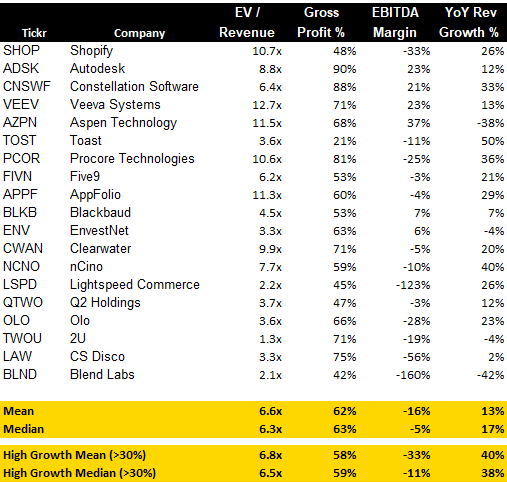

Vertical Software Multiples 8/13/2023

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Reply